OD-KFK – HOW IT WORKS

(OD = Own Damage; KFK = Knock for Knock)

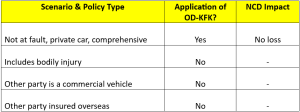

When OD-KFK is Apply

When your private vehicle (comprehensive policy) is damaged by another vehicle in an accident and you are not at fault:

- You claim the repair costs using your own insurer under the OD-KFK scheme.

- Your No-Claim Discount (NCD) is not affected.

- Your insurer handles the repair and subsequently recovers the cost from the other party’s insurer at fault.

- The process is typically faster and more convenient, as you only deal with your own insurer.

When OD-KFK Does Not Apply

OD-KFK claims are not applicable if:

- There is third-party bodily injury, regardless of who is at fault.

- The other party’s vehicle is a commercial vehicle (e.g., bus, taxi, limousine, hire-and-drive).

- The other vehicle is foreign-registered or insured by a non-Malaysian insurer.

Summary Table

REAL CASE EXAMPLE:

One user described an incident where their private car was hit by a tour bus. The insurer told them that OD-KFK does not apply in such cases, because buses are excluded, even though the user was not at fault. As a result, they had to claim under Own Damage, which reset their NCD.

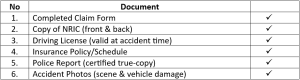

OD-KFK Claim Checklist

Policyholder Documents

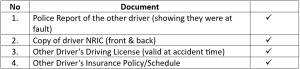

Other Party’s Documents (needed for OD-KFK validation)

(Your insurer may request these from the police or the other insurer under the Knock-for-Knock agreement, but may ask for your help to provide them.)

(Your insurer may request these from the police or the other insurer under the Knock-for-Knock agreement, but may ask for your help to provide them.)

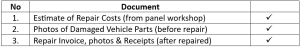

Workshop Documents

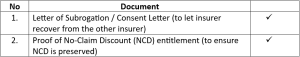

Additional Documents

Contact us now for a free consultation:

1.) Mr. Chap : 012 – 286 1817

2.) Office : 03 – 2162 2515

3.) Email : insurance@edindings.com