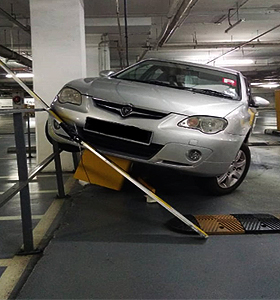

A Joint Management Body (JMB) filed a claim for damages to:

– third-party vehicle; and

– the barrier gate.

caused by a malfunction in the barrier gate system.

A Joint Management Body (JMB) filed a claim for damages to:

– third-party vehicle; and

– the barrier gate.

caused by a malfunction in the barrier gate system.

A Joint Management Body (JMB) filed a claim for damages to third-party property caused by overflowing discharge water.

The insured submitted a claim for the replacement of a melted neutral cable.

The insured submitted a third-party claim for bodily injuries and property damage to his bike after falling next to a road construction site.

A hotel suffered a fire incident, that damaged the hotel building structure & rooms.

The insured submitted a claim for theft of cables.

We have received a claim for damages to the roof ceiling and 3rd party vehicle due to a windstorm.

Received a claim for a roof structure that collapsed during construction.

The insured reported a flood at their warehouse.

Received a medical claim due to an Infected Penile Wound.

Condo Management sent a claim for damage to a neighbor’s wall caused by a falling tree.

The Court of Appeal has upheld a lower court ruling that the management of a car park was liable for negligence, and ordered damages for a missing car.

Management received a claim from a unit owner for rat bait poisoning to his dog.

Received a claim from an Infra contractor company for Drainage slope retaining wall collapse during the Defect Liability Period (DLP) / maintenance period.

Received a claim for damage to a house unit caused by the bursting of concealed sewerage pipe.

Received report from building management for an injury to 3rd party caused by the lift.

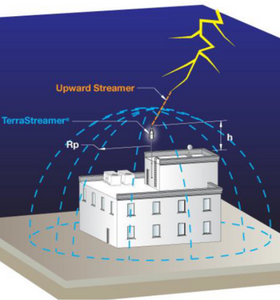

A Condominium reported 5 lightning damage claims within a year period, resulted the claims ratio of more than 200%.

The existing insurer and others four (4) insurance companies refused to provide renewal quotation.

Received a claim from a management corporation for water tank at roof top burst.

Received an enquiry from a condominium for a cracked extended rooftop caused by a cat’s body that was either thrown down by someone or the cat could have accidentally fell on its own.

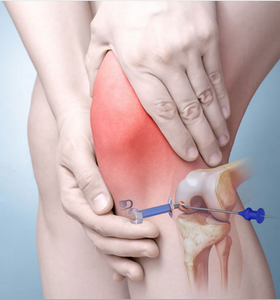

Received a claim for knee surgery known as “JOINTREP” for the implant treatment.

Received a claim for damage property due to falling tree caused by strong wind.

Received a claim for wall collapsed due to heavy windstorm, adjuster visited the site incident on the next day.

Received a claim from a Management Residence for damage to a 3rd party vehicle parked at the lobby due to impact from scaffolding.

Received a claim from a Condo for water meter pipe burst. The claim happened 2 months before policy renewal date. Total repair cost was about RM32k++.

A Condo Management reported of bursting water pipes at the pump room causing damage to four lifts.

Received a call from a condominium about a flashover that caused damage to the vacuum circuit breaker on Saturday morning.

Informed the Insurer immediately and Adjuster visited the incident site on the same day.

The incident resulted in the power supply being interrupted.

A claim was reported from a condominium about a damage to the card access system for the barrier gate caused by lightning.

Received a claim from an International School student who injured his right knee while paying volleyball.

Insured reported of a golfer who fire a Hole in One in a game at a country golf club and the case was immediately registered with the insurer.

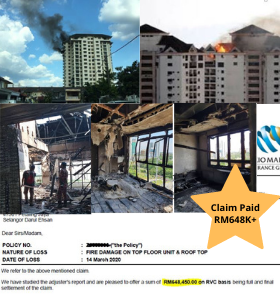

Fire incident happened to a condominium penthouse and on the building roof top. The insurer was immediately be informed and adjuster visited site of incident on the same day.

A M&E contractor submitted a claim for stolen cable at the site of a project.

A shopping mall was flooded due to the bursting water pipe and caused damages to all goods & fittings in few shops lots

A M&E Contractor reported a cable theft claim in a project site where the installed cable had been cut and stolen in all 15 floors inside the building.

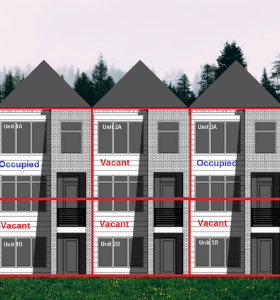

On 4th June 2020 neighbors complained of water leakage affecting few units, on 9th June adjuster visited the site of incident and discovered six units were affected and the cause was an overflow of sewerage pipe from unit 2A.

The Subsidence Landslip that occurred at a newly Condo due to heavy downfall, caused the damage to the water outlet and drainage system.

OMG! Total stolen item worth RM150,000++

Wah! How this happen?

A car suddenly knocked into the barrier gate while leaving a shopping mall. Luckily the driver escaped injury.

The Dog Vs. Joint Management Body (JMB)

A German Shepherd, lived at a condominium with his owner. Everything was peaceful, until one fine day the dog owner lost control, and the dog bite a visitor, a tuition teacher who suffered a torn pants

A “PUPPY” Vs. Joint Management Body (JMB)

A puppy was kept by a tenant who stay in a condominium. JMB decided to take action, to advise her to move the dogs away from the Condo as this was against the Condo house rules. Excuses were given on why she insisted to keep the dogs, as it was a companion and part of her life and must be with her.

She engaged a lawyer to fight her rights and the case ended in the Tribunal Court. To defend the case, the JMB also engaged a lawyer for legal advices.

Verdict of the Tribunal Court, fined the dog owner of RM200.00 in favor of JMB.

Bursting Water Pipes – Damage to Lifts

On 6 Aug 2019 informed by a Condo Management Office of bursting water pipes at the pump room causing damage to four of their lifts.

We immediate notified the insurer to register the claim. The appointed adjuster visited the site of incident on the same day.

On 13 Aug 2019 the duly completed Claim Form and Incident Report were sent to the adjuster for processing together with a quotation of RM900k++. The condo management admitted that they didn’t review and negotiate, because they are not the “Lift Expert” and just leave it to the vendor and accept their proposal.

In view of the substantial claims amount, Approved Group International (AGI) was appointed as the forensic, to further assess on the damages.

A Resident’s Car Hit by Parking Barrier Gate

Received an accident report from a condominium management office, the car park barrier gate was malfunction and hit on a resident car. It caused the car front bonnet dented and paintwork was scratched. The car owner is claiming the damages from the JMB.

A Flying Object Hit on Student Forehead

It was raining heavily and the wind was strong. A student was walking back to the condo, as he passed the guardhouse, suddenly an unknown flying object hit his forehead and caused serious injury that needed at least 10 stiches. An incident report was raised by the condominium management office.

Stolen Generator Set

This was a theft case happened in two blocks of Condo simultaneously. These two buildings were situated side by side. It was reported that the generator room was broken in and the key component of the generator set was dismantled.

A Shopper Fell Inside Toilet

While in the toilet of a shopping mall a shopper suddenly fell and suffered a broken bone. A complaint was lodged against the Mall Management for negligence as the floor was wet when she fell and claimed for compensation.

Broken Glass Windows (Claim Settlement within 3 Hours)

Received a report from Condo Management for a broken glass window.

Cables Damaged During Transit

This is a cable manufacturer company. The company engaged a third-party transporter to deliver their finished products to their customer at Terengganu.

The cables were damaged during transit. The main cause was due to poor stacking and no proper tightening of the stocks on the lorry