The Importance of “Public Liability Insurance”

A public liability insurance policy will protect your business from claim made by third parties for injuries to the person, or damage to property caused as a result of your business activities.

If the above said steel company has the “Public Liability Insurance” in place, then they are protected!

The insurance will indemnify them against all sums which they become legally liable for damages and claimant’s costs and expenses in respect of:

– Bodily injuries including illnesses to any person;

– Legal expenses incurred in legal proceeding defence.

Public Liability insurance – what does it cover?

As a a business owner, you would want to protect yourself against your legal liability to anyone who walks into your business premise. Public Liability insurance is considered essential in businesses which involve regular interactions between the members of the public and the company.

A public liability insurance policy will protect your business from claim made by third parties for injuries to the person, or damage to property caused as a result of your business activities.

A typical policy will pay for the cost of putting right any damage, or medical fees in case of injuries. It will also cover the potentially crippling costs of legally representing your business, related expenses, any any damages your business is found to owe in-relation to a claim.

You should consider taking out public liability insurance if members of the public visit you at your place of work, or if you perform work at places of work owned by third parties.

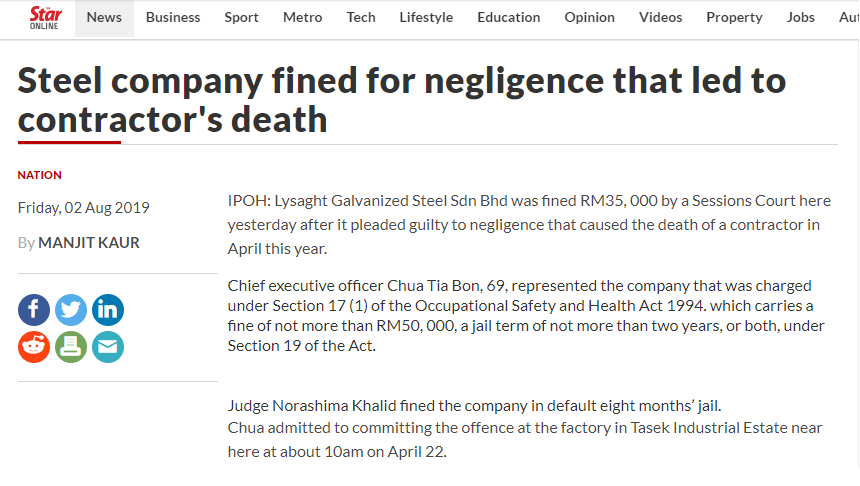

Please visit the below link for the full article of news.

https://www.thestar.com.my/news/nation/2019/08/02/steel-company-fined-for-negligence-that-led-to-contractor039s-death

Contact us now for a free consultation on insurance related matters

1. Email your queries to insurance@edindings.com or

2. Call us at 012-2861817 (M), 03-21622515 (O)